Gain access to government-regulated, high-yield investments in real estate-secured tax liens offered through a fund managed by experienced General Partners and designed to generate 8–18% returns, uncorrelated to market swings.

When property owners fall behind on taxes, counties auction tax lien certificates first-position liens that grant investors the legal right to collect what’s owed, often with interest up to 18%.

You’re not buying distressed real estate. You’re stepping into the shoes of the government, backed by property and protected by law.

not equity-dependent

= top of capital stack

typically 8-18%

and state-regulated

correlated

Invest in physical properties with high returns. Long-term growth and passive income await.

Earn interest or acquire property by investing in tax liens. Secure and profitable investment strategies.

Invest in physical properties with high returns. Long-term growth and passive income await.

Earn interest or acquire property by investing in tax liens. Secure and profitable investment strategies.

And municipal deficits widening, counties are issuing more liens and few investors understand how to access them.

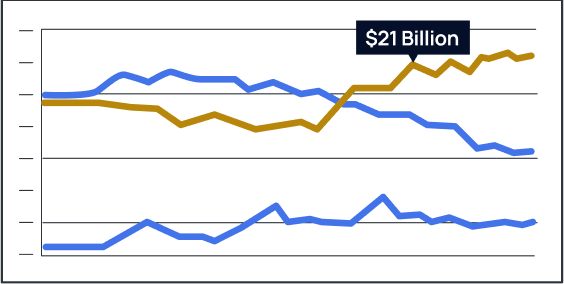

Data Callout (Based on IRS & County Reports):

Over $21 billion in delinquent property taxes annually

Billions in lien opportunities

And municipal deficits widening, counties are issuing more liens and few investors understand how to access them.

While most investors treat tax liens like lottery tickets, we use proprietary data models and legal oversight to build predictable, secured yield for our LPs.

States with judicial enforcement

litigation, or low-value properties

For lien-to-value + redemption behavior

>50% equity and low contest risk

no third-party servicers

Verify accreditation & receive deal access

View lien portfolio allocations and return profiles

Watch your capital go to work immediately

No. Tax deeds transfer property. Tax liens allow you to earn interest from unpaid taxes secured by real estate, without ownership hassles.

Our target returns are 8–18% annually, paid quarterly. Each investor receives a K-1 and full financial reporting.